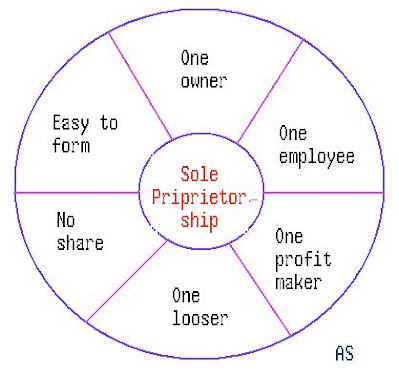

A sole proprietorship is a business where there will be only one owner of the business and he will be responsible for both- profit as well loss.

Again, a sole proprietorship is a business structure where only one person owns it. Sole proprietorships are not taxed at the individual level, but rather at the corporate level. In addition, sole proprietorships do not have to pay social security taxes. However, they may have to pay self-employment tax.

|

| Sole Proprietorship |

It is the oldest and most common form of business. Most of the people of the United States are engaged in this business. Eight business out of ten is sole proprietorships in the United States.

People engage in sole proprietorship because -

- It is easy to form.

- Retain all profits

- Personal satisfaction

- Freedom in decision making

- No tax to give

- No problem of law