Accounting

Accounting is the process of recording transactions and events that occur over time. It includes the preparation of financial statements, which summarize the information recorded about a business's activities over a specified period of time.

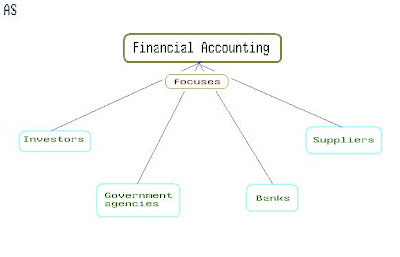

Financial Accounting

Financial accounting is the practice of preparing financial reports about a company's finances. These reports provide information about a company's assets, liabilities, revenues, expenses, shareholders' equity, and cash flows.

Financial accounting focuses on reporting to external parties such as investors, government agencies, banks, and suppliers.

It measures and records business transactions and provides financial statements that are based on generally accepted accounting principles (GAAP). Managers' compensation is often directly affected by the numbers in these financial statements.

Different Terms Used in Financial Accounting

Balance Sheet

A balance sheet shows what a company owns at a particular point in time. Assets represent everything owned by the company while Liabilities show what the company owes. Equity represents the owners' share of the company.

Income statement

An income statement provides information about how much money was earned and spent by a company during a specific period of time. Revenue is the total amount of money received by a company during a given period. Expenses are the costs incurred by a company to produce goods or services. Profit is the difference between revenue and expenses.

Cash flow analysis

Cash flow analysis is the study of a company's current and future cash position. It examines the relationship between income and expenditures.

Statement of Earnings

A statement of changes in equity (or statement of earnings) summarizes the results of operations for a period of time. Earnings per share is calculated by dividing net income by the number of shares outstanding.

Cash flow statement

A cash flow statement is a report that details the movement of cash in and out of a company. It includes the following sections:

Operating Activities - describes the company's operating activities.

Investing Activities - describes the company’s investing activities.

Financing Activities - describes the company's financing activities.

Changes in Net Position - describes the change in the company's net worth.

Balance Sheet Analysis - is the process of analyzing a company's balance sheet. It helps determine whether the company is financially stable or not.

Income Statement Analysis - is the process where we analyze the income statement of a company. We look at the profit margin, return on investment, and return on capital employed.

Cash Flow Analysis - is the process whereby we analyze the cash flow statement of a company. It helps us understand if the company is able to pay its debts and meet its obligations.

Consequently, managers are interested in both management accounting and financial accounting.

Read More: