Definition of Negotiable Instrument

In simple words, a negotiable instrument is a written document where there is an order to give the written amount of money to the bearer or a specific person.

A negotiable instrument means a promissory note, bill of exchange, or cheque payable either to order or to the bearer.

Types of Negotiable Instrument

There are two types of a negotiable instrument.

- Negotiable Instrument by Statute: Promissory Note, Bill of Exchange, and Cheque.

- Negotiable Instrument by Mercantile usage: Bank Draft, Pay Order, CDR, SDR, Dividend Warrant, Interest Warrant, Refund Warrant.

|

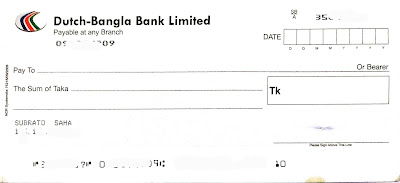

| Cheque: a negotiable instrument |

- bill of lading

- stock and share certificates

- debentures

- dividend warrants

- interest coupons and

- treasury bills

Characteristics of Negotiable Instruments

- It is easily transferable. Almost like cash is transferred from one hand to the other.

- Receivers are specified- drawer, drawee, payee, etc.

- No prior notice is required for such acquisition.

- It must be written and signed by the author.

- Its legal possession is the proprietor of the written amount of money.

- The legal holder may file suit in his own name on the transferable document.

- All the features of the contract are present in the transferable document.

Read more: